venture capital jobs london

But an annual fee. In that role he served as interim CFO for multiple Venture Funds and Startups throughout the country.

How To Get Into Venture Capital Recruiting And Interviews Full Guide

Show more jobs like this Show fewer jobs like this.

. Private Equity Venture Capital Impact Investing Legal Operations Other Reference. MPs revealed they are exploring the potential of venture capital to act as an engine of the governments levelling up agenda today as the Treasury Select Committee opened a. Fuel Ventures Limited is the appointed representative of Sapphire Capital Partners LLP who are authorised and regulated by the Financial Conduct Authority with firm reference number 565716.

Finance Real Estate and Health Technology Companies. London England 8221. Photo by John Gribben for The Points Guy The Venture X is Capital Ones take on the premium travel rewards credit card.

Staff have noticed with 57 of new hires into venture capital jobs in 2021 moving from investment banking according to recruitment firm Dartmouth Partners. Rich Duda served as both Director and Controller of Fund Accounting for ff Venture Capital between 2013 and 2016 and rejoined at CFO in 2018. IMPORTANT NOTICE Investing in start-ups and early stage businesses involves risks including illiquidity lack of dividends loss of investment and dilution.

With a 395 annual fee the card undercuts more expensive competitors in this space such as The Platinum Card from American Express 695 see rates and fees and the Chase Sapphire Reserve 550. The firm has since expanded its US. If they dont get 100 at the very least a private equity firm will secure the majority share effectively claiming autonomy of the company.

11212 A global impact investment fund is currently looking to hire a Paralegal to join their London team to support the legal team with legal. During his time away from the company he worked for Early Growth Financial Services as a Consulting CFO. With a capital of approximately AED370 million the Fund aims to drive Dubais economic growth and fortify its position as a global hub for financial technology FinTech innovation and venture capital.

Venture capital and bank loans finance less than 20 of new businesses. Group to Europe and launched separate venture arms in China and India. Venture capital firms hired more juniors in 2021 than in any other year it has tracked Dartmouth said.

For the rest a parallel market of equity debt and hybrid capital is rising to grow businesses create jobs and. The company has helped create more than 160000 jobs and expanded access to digital financial services in low-income and remote communities Oyinsan says. Finch Capital is a Thematic Growth Investor in technology companies in Finance Real Estate and Health run by exceptional entrepreneurs.

The Fund will come into effect starting June 2022. The book is a fascinating read and illustrates well one of its core themes that venture capital is a network that straddles and offers the virtues of both markets and corporations AnnaLee Saxenian dean of the School of Information at University of California Berkeley A fascinating journey through the tightly networked world of the. What is the Venture X.

It also started wealth-management business Sequoia Heritage and public-and-private hybrid Sequoia Capital Global Equities. UK venture capital firms have also had a record year and raised 7 billion with record-breaking fundraisings from London firms including Index Ventures Balderton Capital 83North and Eight Road. It should be done only as part of a.

PitchBook is the premier resource for comprehensive data on the global capital markets and proprietary research and insights designed to empower your best work. Dawn Capital Venture Capital and Private Equity Principals. At least 2 Million.

Sequoias US venture arm is the firms oldest business dating to 1972. It comes as new research showed that Londons venture capital investors have been tempting staff away from traditional finance to keep up with a boom in investment in the past year which saw. A key difference between private equity and venture capital is that private equity firms usually purchase the entire company whereas venture capitalists only get a portion.

How To Get Into Venture Capital Recruiting And Interviews Full Guide

Ranked The Most Prominent Vc Investors 2021 Dealroom Co

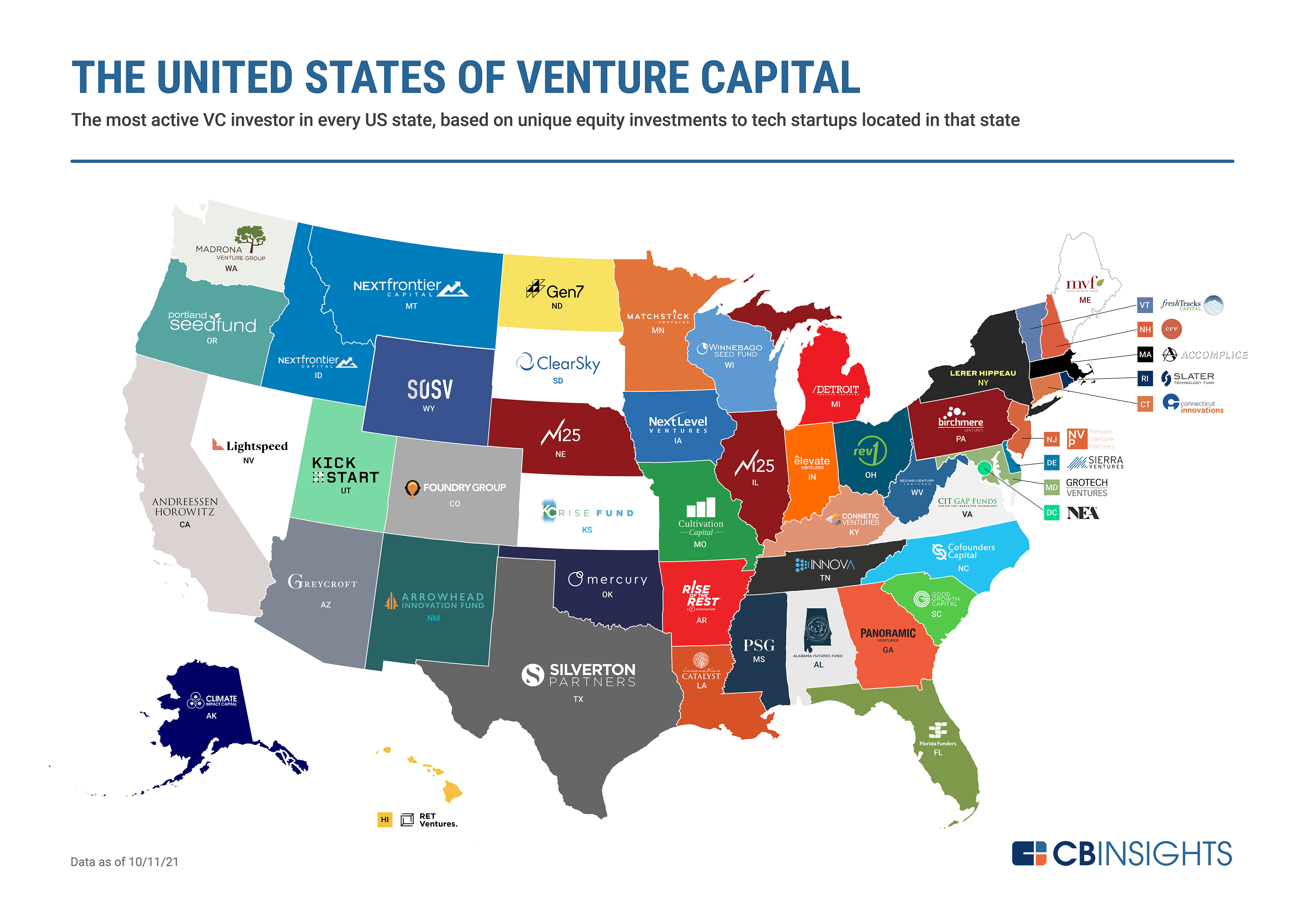

The United States Of Venture Capital The Most Active Vc In Each State Cb Insights Research

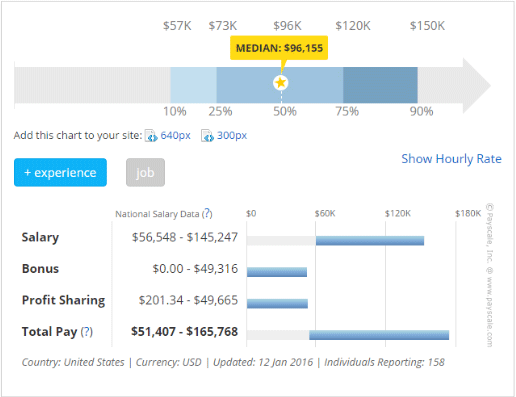

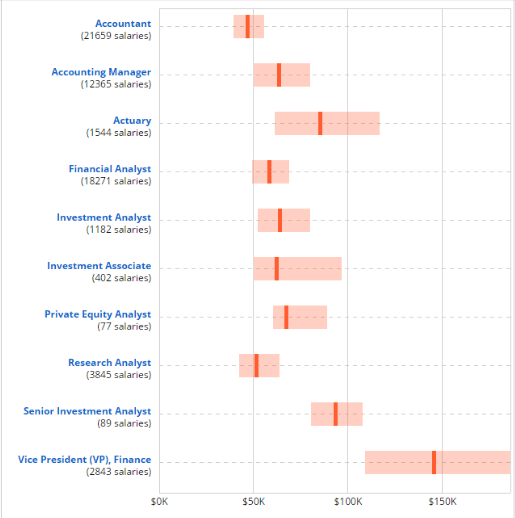

Venture Capitalist Salary Wallstreetmojo

How To Get Into Venture Capital Recruiting And Interviews Full Guide

Outliers Venture Capital Linkedin

Full Article Venture Capital 20 Years On Reflections On The Evolution Of A Field

Top Vcs On How To Break Into Venture Capital Techcrunch

Venture Capitalist Salary Wallstreetmojo

British Private Equity Venture Capital Association Bvca Linkedin

How To Get Into Venture Capital Recruiting And Interviews Full Guide

Lbs Private Equity Venture Capital Club Linkedin

Jobs Earlybird Venture Capital Job Board

Private Equity Venture Capital Jobs

The Bright New Age Of Venture Capital The Economist

Seed Vc Fund Uk Early Stage Venture Capital Fund London Uk Fuel Ventures