are salt taxes deductible in 2020

Help us continue our work by making a tax-deductible gift today. This so-called extender in the Further Consolidated Appropriations Act 2020 reauthorized the deductibility of PMI and FHA MI premiums not only for the 2019 and 2020 tax years but also make PMI premiums retroactively deductible for the 2018 tax year too.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

In Notice 2020-75 the IRS confirmed that PTEs are permitted to fully deduct entity-level state and local income taxes.

. Increasingly many states have shifted to single sales factor apportionment where only a companys sales are taken into account with the intention of benefiting in-state production while exporting more of. Salt Lake City UT 11240 South River Heights Drive South Jordan UT 84095 801 313-1900. The traditional evenly weighted three-factor apportionment method weighs property payroll and sales in equal measure.

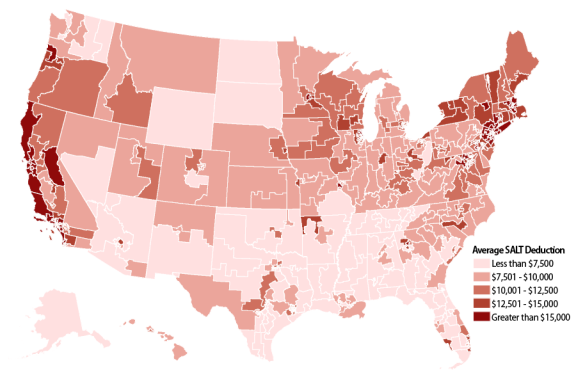

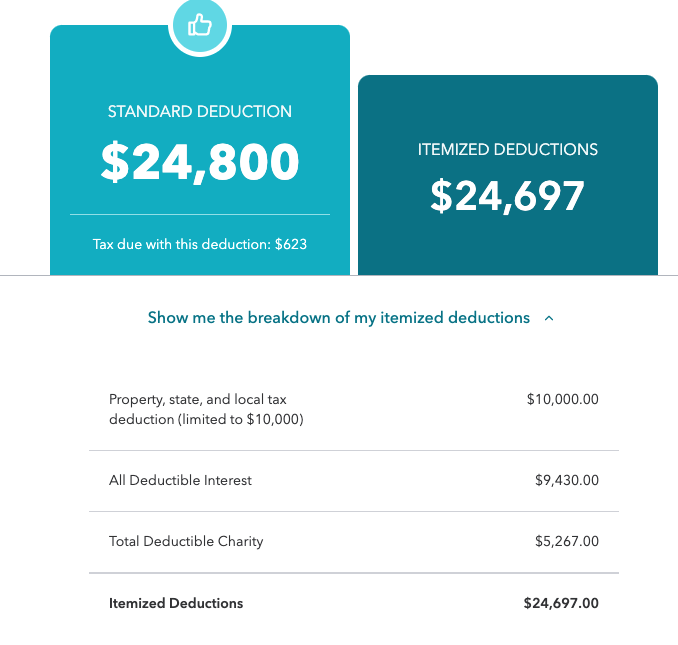

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. The 2020 SALT deduction The SALT deduction which stands for State and Local Taxes was perhaps the most controversial part of the changes to the individual tax code made by the Tax Cuts and Jobs Act. This SALT deduction limitation applies to taxable years beginning after December 31 2017 and before January 1 2026 and does not apply to taxes described in section 164a3 that are imposed by a foreign country or to any taxes described in section 164a1 and 2 that are paid and incurred.

Two big changes in 2020 were self employed people were able to. John properly filed his 2020 income tax return. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face late tax payment.

The entire 12000 will be deductible on the federal return as a charitable contribution and the taxpayer will qualify for a 10200 credit to offset state income tax. And iv general sales taxes. State and Local Taxes SALT If any of the above apply its easy to take some.

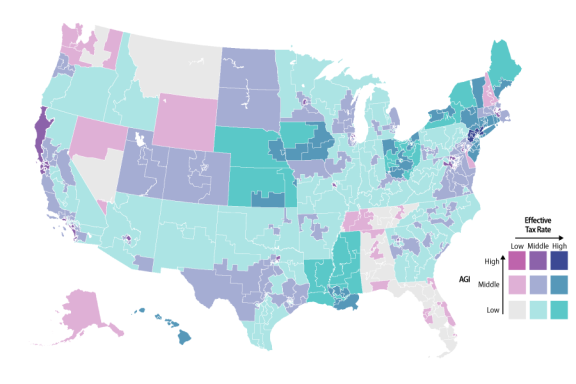

Prior to the limits enactment the cost in lost revenue for the federal government for the SALT deduction was estimated at 78 billion and. These include income taxes or general sales taxes real estate and personal property taxes. In response a number of states have enacted new entity-level taxes on PTEs designed to permit the entity to deduct state income taxes that the individual owners would have otherwise been unable to deduct under the SALT cap.

Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021. While income from rent is not tax deductible owning real estate in the long-term is subject to lower capital gains taxes. As such the contributions are deductible on federal income tax returns as state income taxes for those taxpayers that elect to itemize their deductions subject to the 10000 SALT deduction cap.

Taxpayers are allowed to take an itemized deduction for state and local taxes paid on income sales real estate and personal property through the state and local tax SALT deduction. Tax deductions are a form of tax incentives along with exemptions and creditsThe difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable income while credits. Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses particularly those incurred to produce additional income.

With the passage of the TCJA the SALT deduction is now limited to 10000 5000 if married and. For Tax Year 2021 teachers or educators can generally deduct unreimbursed out-of-pocket school trade or educator business expenses up to 250 on their federal tax returns using the Educator Expense DeductionYou do not have to itemize your deductions to claim this. Whether or not you think about them taxes impact a significant number of your business and personal decisions.

Planning your tax position ahead of time with a qualified CPA is the best strategy to avoid negative implications. If you and your spouse are both educators or teachers and your filing status is Married Filing Jointly you. Spanish Fork UT 765 N.

Under CT tax law state income taxes. The Tax Cuts and Jobs Act of 2017 instituted a temporary 10000 cap on the annual deduction and the number of claimants and average amount deducted fell. Components such as the tax treatment of 2020 unemployment benefits and phaseout thresholds for economic impact payments were changed.

We depend on the generosity of individuals like you. COVID-19 the American Rescue Plan Act of 2021. The federal tax reform law passed on Dec.

The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021.

Average tax rates show the overall share of income paid in taxes. Improving Lives Through Smart Tax Policy. If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses.

The Salt Cap Overview And Analysis Everycrsreport Com

Irs Releases Long Awaited Guidance On State And Local Tax Workarounds

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Is The Salt Deduction H R Block

The Salt Cap Overview And Analysis Everycrsreport Com

/GettyImages-56970357-5867cc515f9b586e02191b68.jpg)

Salt State And Local Tax Definition

S Corp Workaround For Salt Deduction Cap Wcre

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Your 2020 Guide To Tax Deductions The Motley Fool

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

The Salt Cap Overview And Analysis Everycrsreport Com

Beating The Standard Deduction With Strategic Giving

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)